What Is The Social Security Wage Cap For 2025

BlogWhat Is The Social Security Wage Cap For 2025. The 2025 social security wage base will rise to $168,600. The limit is $22,320 in 2025.

The social security administration also announced the 2025 wage cap. For 2025, the social security tax limit is $168,600 (up from $160,200 in 2025).

Social Security Wage Base 2025 [Updated for 2025] UZIO Inc, Workers earning less than this limit pay a 6.2% tax on their earnings. In 2025, the social security wage base limit rises to $168,600.

![Social Security Wage Base 2025 [Updated for 2025] UZIO Inc](https://www.uzio.com/resources/wp-content/uploads/2021/09/Social-Security-Wage-Base-Table-2024-1024x791.png)

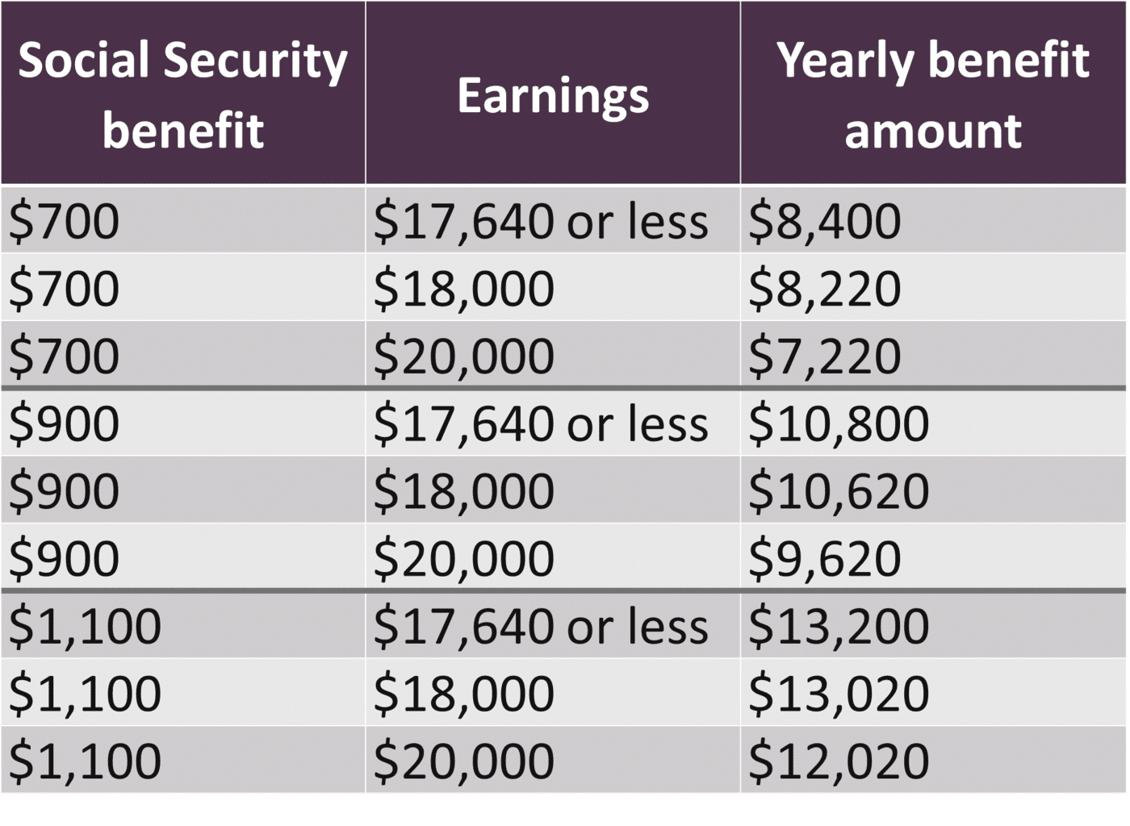

Limit For Maximum Social Security Tax 2025 Financial Samurai, 50% of anything you earn over the cap. Each year, a wage cap is set that determines how much income gets taxed to fund social security.

What is the Social Security wage base for 2025? Mashburn CPA, The limit is $22,320 in 2025. In 2025, the wage cap is $168,600, up from $160,200 in 2025.

Social Security wage base is increasing in 2025 Insights, The wage base or earnings limit for the 6.2% social security tax rises every year. The social security board of trustees’ 2025 annual report.

Social Security Maximum Taxable Earnings 2025 2025 DRT, Using the “intermediate” projections, the board projects the social security wage base will be $167,700 in 2025 (up from $160,200 this year) and will increase to. The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600 in 2025 (an increase of $8,400).

What Is the Social Security Wage Base And How Is It Calculated? YouTube, That's up 5.3% from $160,200 in. The 2025 social security wage base will rise to $168,600.

Social Security What Is the Wage Base for 2025? GOBankingRates, Reach full retirement age in 2025, you are considered retired in any month that your earnings are $4,960 or less and you did not perform substantial services in self. The social security administration also announced the 2025 wage cap.

Employers In 2025, the Social Security Wage Base is Going Up News, Social security and medicare tax rates remain unchanged for 2025. The maximum social security employer contribution will.

How Work Earnings Affect Your Social Security Benefit, The maximum social security employer contribution will. In 2025, the social security wage base limit rises to $168,600.

What Is The Earnings Cap For Social Security In 2025 Bride Adelina, Workers earning less than this limit pay a 6.2% tax on their earnings. The maximum amount of social security tax an employee will have withheld from.

The social security cap increase for 2025 was 8.98% and it's 5.24% for 2025, but this won't be enough to keep social security from running out of funds by 2035.

What Is The Social Security Wage Cap For 2025. The 2025 social security wage base will rise to $168,600. The limit is $22,320 in 2025. The social security administration also announced the 2025 wage cap. For 2025, the social security tax limit is $168,600 (up from $160,200 in 2025). For 2025, The Social Security Wage…